Research

The VERA Centre aims at improving resilience in economics and society, preventing, predicting, measuring, and managing risks thanks to the use of big data sources. Big data has changed the way that we understand existing social challenges, and it has created entirely new research questions, which call for advances in science. The goal of the VERA Centre is to investigate these questions focusing on three main thematic macro-areas of interest in public policy making: welfare and wellbeing, environment, macroeconomics and finance.

Main research activities

Analysis of social risks related to welfare system and wellbeing

The challenge is to understand how to ensure economic growth and social wellbeing for a socio-economic system with complex structure and dynamics. The complexity of the relationships between markets, institutions and public authorities makes the decision process even more difficult. A first response to this challenge is the opportunity to analyse and integrate big data from different sources (individual micro-data, experimental data, big data from administrative records, georeferenced data, etc.) to support the decision making process.

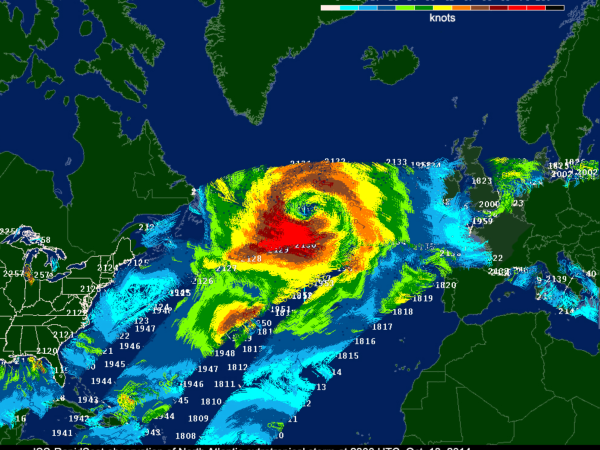

Analysis of environmental and climate risks and related impacts

Economic analysis at territorial level for disaster risk assessment and management, including the analysis of the different physical, social, economic and environmental factors or processes such as climate change, overconsumption of natural resources, poverty and inequality. Big data from sensor networks and from social media provide the opportunity to improve disaster risk prediction and management.

Analysis of financial and macro-economic risks

Analysis and evaluation of financial and macroeconomic risks, also in cooperation with financial authorities. The activity and regulation of financial markets produce a large amount of data that can be an essential source of information for a deep understanding of the agent behaviour and the markets dynamics. Big data can be used in the supervisory activity to measure and manage financial risks, market instabilities and sustainability.

Research projects

European, national and local projects of the Department of Economics related to relevant research topics of VERA Center during the period 2018-2022.

European projects

EIBURS Project “ESG-Credit.eu - ESG Factors and Climate Change for Credit Analysis and Rating”

The aim of the ESG-Credit.eu project is to implement a methodology to include environmental, social and governance (ESG) criteria in credit analysis and ratings, including specifically the impact of climate change. Given that ESG factors measure the firm’s sustainability and its ethical skills, the project investigates how those factors affect the creditworthiness of a firm measured by credit ratings over time. Moreover, the project includes in the analysis the impact that climate change could exert over a firm belonging to a certain industry. The expected result of the ESG – Credit.eu project is to introduce augmented credit rating which include ESG factors and climate change scenarios.

Principal Investigator: Monica Billio

Duration: December 2019 - November 2022

EeMMIP- Energy Efficient Mortgage Market Implementation Plan

The Energy Efficient Mortgage Market Implementation Plan (EeMMIP) will build on efforts to develop Energy Efficient Mortgage (EEM) by delivering an integrated market and a blueprint for established and emerging markets around the globe. The Project will conduct an analysis of the current market systems relevant to the development of an EEM market and establish demonstrators to support the end-to-end customer journey and EEM life-cycle. It will establish market-based governance and an EEM Label to support recognition of and confidence in EEM and facilitate access to quality information for market participants. The project will deliver guidance for the inclusion of energy efficiency in credit risk assessments for lending institutions and supervisors and policy recommendations for the prudential framework in line with the principle of risk sensitivity and promote a well-functioning banking market.

EeMMIP will build on and complement the ongoing efforts under the Energy Efficient Mortgage Initiative (EEMI), which brings together the ongoing EU-funded Energy Efficient Mortgages Action Plan (EeMAP) and Energy Efficient Data Portal & Protocol (EeDaPP) Initiatives, by moving beyond the design of the product to deliver an integrated market for the EEM product. www.energyefficientmortgages.eu

Principal Investigator: Monica Billio

Duration: 2020 - 2022

ENERGYA - Energy Use for Adaptation

ENERGYA will improve our understanding of how energy and energy services can be used by households and industries to adapt to the risk posed by climate change. Specifically, the project will develop an interdisciplinary and scalable research framework integrating data and methods from economics with geography, climate science, and integrated assessment modelling to provide new knowledge concerning heterogeneity in energy use across countries, sectors, socioeconomic conditions and income groups, and assess the broad implications adaptation-driven energy use can have on the economy, the environment, and welfare. ENERGYA has three main objectives:

- Analyze historical data on energy use in relation to climate and weather. The project will produce novel statistical and econometric analyses for OECD and major emerging countries (Brazil, Mexico, India, and Indonesia) to shed light on the underlying mechanisms driving energy use;

- Develop future scenarios of climate-induced energy demand at global scale, building on the historical empirical evidence;

- Asses the environmental and socio-economic implications of future energy needs across and within countries.

Principal Investigator: Enrica De Cian

Duration: March 2018 - February2023

ACTION-Assessing Climate TransItion OptioNs: policy vs impacts

The 2015 Paris Agreement is a key step towards strengthening a global response to address the threat of climate change. It sets global objectives that all signatory countries have to contribute to achieve through the implementation of urgent actions to reduce greenhouse gas emissions and promote climate-resilience and low-carbon development. ACTION project aims at enhancing transparency and comparability among countries’ climate change policies while offering insights into a fair and just transition toward the sustainable development. The project will develop a quantitative approach to empirically assess national climate policies in terms of severity, drivers and economic impact. Project results will assist policymakers in understanding the effectiveness of coordinated policy efforts and design their future climate agenda. ACTION will be hosted in two highly qualified institutions: during the outgoing phase (24 months) at Harvard Kennedy School of Government, under the guidance of Prof. Aldy, and during the incoming phase (12 months) at the Department of Economics of Ca’ Foscari University. The supervisor of the project is Prof. Enrica De Cian.

Principal Investigator: Marinella Davide

Duration: February 2020 - January 2023

SHARE-COHESION Cohesion in further developing and innovating SHARE across all 28 member countries

SHARE, the Survey of Health, Ageing and Retirement in Europe, is a research infrastructure to better understand and cope with the challenges and chances of population ageing. The main objective of SHARE is to provide excellent data for aging research through a combination of (a) transdisciplinarity, (b) longitudinality and (c) European coverage with strict cross-national comparability through ex-ante harmonisation. With its recent seventh wave, SHARE succeeded in covering all EU member states in cooperation with the British Isles Surveys (UK and Ireland). The coverage of all EU member states (plus Switzerland and Israel) is particularly attractive for both scientific and Commission users because it permits cross-national comparisons of the economic, health and social situation of EU citizens aged 50 and over and allows for comparative evaluations of aging-related policies such as pension, health and long-term care reforms. The project will support the supra-national innovation and development tasks during Waves 8-10 of SHARE, thereby improving the scientific state-of-the-art of SHARE and cross-national cohesion across all 28 SHARE member countries. It addresses all seven targets of this call and the related sustainability criteria. Scientific innovation encompasses new questionnaire content including device-based measures; development encompasses more efficient survey methods including new electronic tools.

Principal Investigator: Agar Brugiavini

Duration: October 2019 - September 2023

SMARTCULTOUR - Smart Cultural Tourism as a Driver of Sustainable Development of European Regions

SmartCulTour aims to support regional development in European regions, with special attention to rural peripheries and the urban fringe, through sustainable cultural tourism. The project redefines cultural tourism through a contemporary lens and provides a comprehensive measurement framework for supply, demand and impacts. In order to support knowledge-led destination management, a decision-support system (DSS) will be developed for wide-scale monitoring purposes across European regions. The DSS will synthesize both traditional and non-traditional data sources, the latter particularly related to big data analytics, thereby assisting smart regional development. Besides a contribution to conceptual development and cultural tourism measurement, the main objective of SmartCulTour relates to the facilitation of community-led rural development through field experimentation in 6 living labs. Prior to these living labs, a comprehensive desk research will identify significant sustainable cultural tourism policies, their impacts and critical success factors. These best cases will inspire a series of possible local interventions. Within the living labs, novel creative approaches to stakeholder engagement are tested, notably arts-based methods, serious games, and service design which will help to provide local context and support. A toolkit will be designed to help destinations implement local actions towards sustainable cultural tourism development. SmartCulTour will therefore contribute to theory development, empirical validation of best practices within a living labs setting, and procedural development, particularly by providing European regions with a set of strategies to optimally engage with stakeholders and co-create sustainable cultural tourism experiences.

Principal Investigator: Nicola Camatti

Duration: 2020 - 2024

TranspArEEnS - mainstreaming Transparent Assessment of Energy efficiency in Environmental social governance ratingS

Improving access to long-term finance for Energy Efficiency (EE) projects is key to achieve the EU2030 targets and aligning the COVID-19 recovery to the European Green Deal. However, the lack of standardized disclosure of EE investments limits firms’ access to EE financing. Further, poor understanding of EE information in ESG ratings increases the risk of greenwashing, thus preventing a smooth development of the sustainable finance market. TranspArEEnS addresses these barriers by mainstreaming a quali-quantitative framework for standardized collection and analysis of firms’ EE and ESG information and the development of a standardized EE-ESG rating. This serves as an EE-ESG filter to inform investment and financial policy decisions with regard to portfolios’ alignment to sustainability. A unique added value of this project is to cover non-listed Small and Medium Enterprises, meeting an important market need. TranspArEEnS’ EE-ESG rating will be tested in pilot case studies and capacity building sessions with leading representatives of the financial industry and supervisors. TranspArEEnS’ EE-ESG rating will be tested in pilot case studies and capacity building sessions with leading representatives of the financial industry and supervisors.

This allows to understand barriers and opportunities for its operationalization in:

- credit risk assessment;

- development of long-term EE-financing via securitization (covered bonds, European Secured Notes);

- introduction of EE-ESG considerations into monetary policies and prudential regulations.

By enhancing standardized disclosure of EE investing, TranspArEEnS will decrease uncertainty in the EE and ESG market, thus promoting the scaling up of new EE financing and investment opportunities in the EU. Moreover, it will help to mitigate the risk of greenwashing thus improving financial stability.

Principal Investigator: Monica Billio

Duration: June 2021 - December 2023

WaterLANDS - Water based solutions for carbon storage, people and wilderness

WaterLANDS aims to enable an upscaling of the restoration of wetlands. Socio-economic factors, insufficient stakeholder engagement, lack of government commitment, lack of funding and inadequate exchange of knowledge of restoration methods have all been identified as barriers to successful restoration. Consequently, most restoration has been modest in scale, has occurred mainly where there is a single landowning or responsible organisation, and has often been undertaken principally for reasons of conservation.

WaterLANDS will work to overcome these barriers. It includes both Action and Knowledge Sites, the former being the object of restoration upscaling, and the latter a source of best practice experience and knowledge. To provide for local support and sustainability, it will aim for the co-design of restoration with the on-going engagement of communities and stakeholders. It will investigate best practice in ecological restoration which meets both biodiversity and social objectives and for which restoration trajectories are specific to the physical and cultural context of the Action Sites.

It will propose supportive governance structures appropriate to this process and to local and national circumstances. It will identify business models, economic incentives and international funding sources and tailor or direct these resources for each site. The project will pull this expertise and knowledge together in a cocreation work package. Process-indicators will be developed to enable on-going assessment of restoration success in terms of ecosystem services, socioeconomic embedding and financial sustainability, to ensure wide-scale restoration which catalyses scalability beyond the life of the WaterLANDS project.

Principal Investigator: Carlo Giupponi

Duration: October 2021 - September 2026

ESG Uptake - ESG risk management framework for the financial sector

ESG-UPTAKE is a project, funded by EU Commission DG-Reform and coordinated by Ca’ Foscari University of Venice, to strengthen the capacity EU Member States' National Competent Authorities (NCAs) to monitor and address ESG (Environmental, Social, and Governance) and climate risks in the financial sector.

Specifically, the project supports a selected group of 11 NCAs in identifying, monitoring, and assessing the impact of ESG risks on their supervised entities and the entire financial sector.

ESG-UPTAKE aims to facilitate the uptake and implementation of a risk-based supervisory approach to assess and mitigate ESG and climate risks. This approach is complemented by reporting systems, data, and methodologies based on best practices. This, in turn, will enhance NCAs' ability to manage ESG risks promptly and appropriately (including through ESG and climate stress-tests), assess and oversee compliance with ESG and climate-related disclosure and reporting requirements, thereby contributing to informing the adoption of appropriate supervisory responses.

Principal Investigator: Monica Billio

Duration: September 2023 - August 2026

National projects

Hi-Di NET - Econometric Analysis of High Dimensional Network Structures in Macroeconomics and Finance

High dimensional modelling and large dataset handling have gain attention in Economics and Finance, given also the recent surge of publicly available data. One of the key challenges of high-dimensional models is the complex interactions among variables and the inferential difficulty associated with handling large datasets. The project Hi-Di NET deals with the 3 key aspects for forecasting and structural analysis: network effects and interconnectedness; time variation in the relationships; large cross section of variables and high dimension databases. It is organised in 3 WPs dealing with: inclusion of network into time series analysis to deal with dynamics and time dependence; inference on observed and latent networks and identification issues; use of large datasets and related computational challenges. The aim is to develop novel multivariate econometric models and efficient methods suitable for high dimension databases and able to deal with network effects and time varying relationships.

From an applied perspective, the Hi-Di NET project will deal with the central theme of financial and macroeconomic stability, declined in 3 empirical vertical streams related to highly relevant topics: systemic risk, uncertainty impact and new fintech instruments.

Website

Project coordinator: Monica Billio, Ca’ Foscari University of Venice

Roberto Casarin, Ca’ Foscari University of Venice

Giuseppe Cavaliere, University of Bologna

Luca Fanelli, University of Bologna

Massimo Guidolin, Bocconi University

Massimiliano Giuseppe Marcellino, Bocconi University

Francesco Ravazzolo, University of Bozen

Fin4Green - Finance for a Sustainable, Green and Resilient Society

Sustainable finance is witnessing unprecedented growth in the sheer value of assets and instruments that account for Environmental, Social and Governance (ESG) factors under various labelling schemes. Unprecedented regulatory developments have also unfolded in Europe (e.g., the introduction of the EU Taxonomy of sustainable activities) and correspondingly, a number of initiatives by financial supervisors have emerged at the global level. Measuring and managing risks related to the sustainability transition is a key scientific challenge with enormous societal impact since it is a precondition to our ability to build a more sustainable and resilient society. Fin4Green addresses this challenge by developing quantitative approaches, both in an econometric and finance perspectives, for a robust assessment and management of financial risks related to sustainability. The project aims to deliver actionable knowledge that can inform the design of policies to support the sustainability transition. This will allow to enable the pivotal role of the private finance sector towards a Sustainable, Green and Resilient Society, and to preserve the financial stability.

Project coordinator: Monica Billio, Ca’ Foscari University of Venice

Roberto Casarin, Ca’ Foscari University of Venice

Giuseppe Cavaliere, University of Bologna

Paolo Giudici, University of Pavia

Massimo Guidolin, Bocconi University

SELECT - Unfolding the SEcrets of LongEvity: Current Trends and future prospects

The rapid social, economic, and technological transformations characterizing our society in the recent years are producing several effects on many complex and dynamic processes of human health. The project focus in particular, on the recent upward trend in longevity, and on its relation with current and future morbidity and disability patterns. The joint analysis of such processes, which plays a key role in many public health systems, requires novel qualitative and quantitative paradigms. The main objective of the project SELECT is to explore the factors and mechanisms of longevity evolution in the recent years and link them with morbidity trends to foster healthy longevity. The goal of this project is to take a relevant step forward in addressing the above problems by relying on a highly interconnected and multidisciplinary team with experience in Demography, Epidemiology, Social Science and Data Science. The team will take advantage from the availability of several datasets to merge public health and epidemiological theories with a data-driven approach based on innovative models.

Website

Project coordinator: Stefano Campostrini, Ca’ Foscari University of Venice

Stefano Mazzuco, University of Padova

Daniele Durante, Bocconi University

Fabrizio Faggiano, University of Piemonte Orientale

HEIRS - High-frequency Economic Indicators and Resilience of Society

This project will demonstrate how high-frequency (daily) electricity consumption data can be used to estimate the causal, short-run impact of exogenous shocks, such as COVID-19 on the economy. In the current uncertain economic conditions, timeliness is essential for effective policy making. Unlike official statistics, our approach can monitor virtually in real-time the level of economic activities, the impact of the containment policies and the extent of the recession. We will also be able to measure whether the monetary and fiscal stimuli introduced are effective in addressing the crisis.

Website

Project coordinator: Francesco Ravazzolo, University of Bozen

Roberto Casarin, Ca’ Foscari University of Venice

Davide Ferrari, University of Bozen

Carlo Fezzi, University of Trento

Local projects

"ANALISI DELLA LEGALITA’ NEL TESSUTO IMPREDITORIALE VENETO" - Analysis of the Legality Issue in the Veneto Region Entrepreneurial System

A protocol agreement between Ca’Foscari University of Venice (departments of Economics and Management), the Comando Regionale Veneto of the Italian finance Police, and Infocamere and Unioncamere Veneto was drawn up in June 2021, for a collaboration that aims to observe and analyze entrepreneurial dynamics in the Veneto region, and the related risk factors related to potential criminal infiltrations.

A round table for sharing data, approaches and methods in order to address and further investigate the issue of legality within the regional economic system.

The collaboration is supported by Regione del Veneto, that aims to be involved in the round table for analysis and research.

This is part of the activities within the framework of the Excellence Project of the Department of Economics, linked to the main research topics of the VERA Center, focusing in particular on the use of big data to support public policies.

The primary goal is to develop a series of experimental research activities for the implementation of both quantitative and qualitative indicators and the definition of new tools for monitoring illegality risk areas in the economy, with a specific focus on economic and financial factors that are a marker of illegal behaviors by companies. The analysis will focus also on the differences and changes between pre-pandemic, current and post-pandemic periods.

“ECCELLENZE DEL NORD EST”- The performance of North-East enterprises

The project, carried out by the 13 Orders of Chartered Accountants and Auditors of North- East Regions in cooperation with the Department of Economics-VERA Centre, developed an analysis of firms performance in the North-East regions (Veneto, Trentino Alto-Adige and Friuli Venezia Giulia). The proposed indicator combines both balance sheet information and opinion of experts by using quantitative methods. The project aims to study also the relationship between the performance and the network structure of the firms with special attention to the topology of interlocking directorate network, the degree of openness of the firm governance, the human capital endowment and the complexity of the firm competences.

The analysis will be conducted on data from the Bureau Van Dijk AIDA dataset and will make use of econometrics and machine learning techniques.

A research grant is funded by the Order of Chartered Accountants and Auditors of Treviso on the following theme: «A Big Data approach to firms heterogeneity and interlocking directorate».

Ca' Foscari University Research Team:

Riccardo Busin

Roberto Casarin

Giancarlo Corò

Fausto Corradin

Mario Volpe

Tullio Buccellato

VERA Research Prize for publication of papers in high quality journals

In May 2020, the VERA Management Board set up a Research Prize to increase the publication of papers in high quality journals by Economics Department scholars.

The Research Prize established a ranking list of journals in the fields of Economics, Econometrics and Statistics, Finance, Operations Research and Management Science, Regional Studies, Planning and Environment, Social Sciences.

The list is mainly based on the Tilburg University Ranking database and on the Academic Journal Guide of 2018 and takes into consideration the journals classified ANVUR - class A.

VERA selected publications

- Agudze K. M., Billio M., Casarin R., Ravazzolo F., 2022, Markov Switching Panel with Endogenous Synchronization Effects, Journal of Econometrics, vol. 230, 2, pp. 281-298

- Billio M., Casarin R., Iacopini M., Kaufmann S., 2022, Bayesian Dynamic Tensor Regression, Journal of Business & Economic Statistics

- Billio M., Casarin R., Iacopini M., 2022, Bayesian Markov-Switching Tensor Regression for Time-Varying Networks, Journal of the American Statistical Association

- Schäfer L.E., Dietz T., Barbati M., Rui Figueira J., Greco S., Ruzika S., 2021, The binary knapsack problem with qualitative levels, European Journal of Operational Research, vol. 289, 2, pp. 508-514

- Basso A., Di Tollo G., 2021, Prediction of UK research excellence framework assessment by the departmental-index, European Journal of Operational Research, vol. 296, 3, pp. 1036-1049

- Bertin G., Carrino L., Pantalone M., 2021, Do standard classifications still represent European welfare typologies? Novel evidence from studies on health and social care, Social Science & Medicine, vol. 281, July 2021

- Antinyan A., Bertone M., Corazzini L., 2021, Cervical Cancer Screening Invitations in Low and Middle Income Countries: Evidence from Armenia, Social Science & Medicine, vol. 273, March 2021

- Galeotti F., Maggian V., Villeval M.C., 2021, Fraud Deterrence Institutions Reduce Intrinsic Honesty, The Economic Journal, vol. 131, 638, pp. 2508-2528

- Gilardi G., Hanley K.W., Nikolova S., Pelizzon L., Getmansky Sherman M., 2021, Portfolio similarity and asset liquidation in the insurance industry, Journal of Financial Economics, vol 142, 1, pp. 69-96

- Salamanca A., 2021, The value of mediated communication, Journal of Economic Theory, vol. 192, March 2021

- Bormetti G., Casarin R., Corsi F., Livieri G., 2020, A Stochastic Volatility Model With Realized Measures for Option Pricing, Journal of Business & Economic Statistics, vol. 38, 4, pp. 856-871

- Corazza M., 2020, A note on “Portfolio selection under possibilistic mean-variance utility and a SMO algorithm”, European Journal of Operational Research, vol. 288, 1, pp. 343-345

- Gale M., Gottardi P., 2020, A general equilibrium theory of banks' capital structure, Journal of Economic Theory, vol. 186, March 2020

- Carroni E., Pin P., Righi S., 2020, Bring a friend! Privately or Publicly?, Management Science, vol. 66, 5

- Billio M., Casarin R., Rossini L., 2019, Bayesian nonparametric sparse VAR models, Journal of Econometrics, vol. 212, Sep 2019, pp. 97-115

- Colonnello S., Efing M., Zucchi F., 2019, Shareholder bargaining power and the emergence of empty creditors, Journal of Financial Economics, vol. 134, 2, pp. 297-317

- Bianchi D., Billio M., Casarin R., Guidolin M., 2019, Modeling systemic risk with Markov Switching Graphical SUR models, Journal of Econometrics, vol. 210, 1, pp. 58-74

- Dindo P., 2019, Survival in speculative markets, Journal of Economic Theory, vol. 181, May 2019, pp. 1-43

- Schuldenzucker S., Seuken S., Battiston S., 2019, Default Ambiguity: Credit Default Swaps Create New Systemic Risks in Financial Networks, Management Science, vol. 66, 5, pp. 1981-1998

- Bertin G., Pantalone M., 2019, Professional identity in community care: The case of specialist physicians in outpatient services in Italy, Social Science & Medicine, vol. 226, Apr 2019, pp. 21-28

- Bassetti F., Casarin R., Ravazzolo F., 2018, Bayesian Nonparametric Calibration and Combination of Predictive Distributions, Journal of the American Statistical Association, vol. 113, 522, pp. 675-685

- Casarin R., Sartore D., Tronzano M., 2018, A Bayesian Markov-Switching Correlation Model for Contagion Analysis on Exchange Rate Markets, Journal of Business and Economic Statistics, vol. 36, 1, pp. 101-114

- Di Corato L., Dosi C., Moretto M., 2018, Multidimensional auctions for long-term procurement contracts with early-exit options: The case of conservation contracts, European Journal of Operational Research, vol. 267, 1, pp. 368-380

Other publications

2022

- Aliverti E., Mazzucco S., Scarpa B., 2022, Dynamic modeling of mortality via mixtures of skewed distribution functions, Journal Of The Royal Statistical Society. Series A, Statistics In Society

- Barro D., Consigli G., Varun V., 2022, A stochastic programming model for dynamic portfolio management with financial derivatives, Journal of Banking & Finance, vol. 140, July 2022

- Bottazzi G., Dindo P., 2022, Drift criteria for persistence of discrete stochastic processes on the line, Journal of Mathematical Economics, vol. 101, August 2022

- Campagnolo L., De Cian E., 2022, Distributional consequences of climate change impacts on residential energy demand across Italian households, Energy Economics, vol. 110, June 2022

- Caporin M., Costola M., 2022, Time-varying Granger causality tests in the energy markets: A study on the DCC-MGARCH Hong test, Energy Economics, vol. 111, July 2022

- Caporin M., Costola M., Garibal J.C.,Maillet B., 2022, Systemic risk and severe economic downturns: A targeted and sparse analysis, Journal of Banking & Finance, vol. 134, January 2022

- Comerford D., Spiganti A., 2022, The Carbon Bubble: climate policy in a fire-sale model of deleveraging, The Scandinavian Journal of Economics

- Di Corato L., Zormpas D., 2022, Investment in farming under uncertainty and decoupled support: a real options approach, European Review of Agricultural Economics, vol. 49, 4, pp 876-909

- Djordjilović V., Chiogna M., 2022, Searching for a source of difference in graphical models, Journal of Multivariate Analysis, vol. 190, July 2022

- Fattoruso G., Barbati M., Ishizaka A., Squillante M., 2022, A hybrid AHPSort II and multi-objective portfolio selection method to support quality control in the automotive industry, Journal of the Operational Research Society, vol. 74,1, pp 209 224

- Harstad B., Lancia F., Russo A., 2022, Prices vs. quantities for self-enforcing agreements, Journal of Environmental Economics and Management, vol. 111, January 2022

- Macchioni Giaquinto A.M., Jones A.M., Rice N., Zantomio F., 2022, Labor supply and informal care responses to health shocks within couples: Evidence from the UK, Health Economics, vol. 31, 12, pp 2700-2720

2021

- Alacevich C., Cavalli N., Giuntella O., Lagravinese R., Moscone F., Nicodemo C., 2021, The presence of care homes and excess deaths during the COVID-19 pandemic: Evidence from Italy, Health Economics, vol. 30, 7, pp 1703-1710

- Antinyan A., Bassetti T., Corazzini L., Pavesi F., 2021, Political Narratives and the US Partisan Gender Gap, Frontiers in Psychology

- Barucci E., Dindo P., Grassetti F., 2021, Portfolio insurers and constant weight traders: who will survive?, Quantitative Finance, vol. 21, 12, pp 1993-2004

- Battiston S., Dafermos Y., Monasterolo I., 2021, Climate risks and financial stability, Journal of Financial Stability, vol. 54, June 2021

- Battiston S., Monasterolo I., Riahi K., van Ruijven B.J., 2021, Accounting for finance is key for climate mitigation pathways, Science, vol. 372, 6545, pp 918-920

- Billio M., Costola M., Hristova I., Latino C., Pelizzon L., 2021, Inside the ESG ratings: (Dis)agreement and performance, Corporate Social Responsibilityand Environmental Management, vol. 28, 5, pp. 1426–1445

- Billio M., Costola M., Pelizzon L., Riedel M., 2021, Buildings’ Energy Efficiency and the Probability of Mortgage Default: The Dutch Case, vol. 65, pp 419-450

- Billio M., Casarin R., Costola M., Iacopini M., 2021, A Matrix-Variate t Model for Networks, Frontiers in Artificial Intelligence

- Billio M., Maillet B., Pelizzon L., 2021, A meta-measure of performance related to both investors and investments characteristics, Annals of Operations Research, vol. 313, pp 1405-1447

- Bisin A., Gottardi P., 2021, Efficient policy interventions in an epidemic, Journal of Public Economics, vol. 200, August 2021

- Bürker M., Mammi I., Minerva A.G., 2021, Civic capital and service outsourcing: Evidence from Italy, European Economic Review, vol. 138, September 2021

- Casarin R., Costantini M., Paradiso A., 2021, On the role of dependence in sticky price and sticky information Phillips’s curve: Modelling and forecasting, Economic Modelling, vol. 105, December 2021

- Castellini M., Di Corato L., Moretto M., Vergalli S., 2021, Energy exchange among heterogeneous prosumers under price uncertainty, Energy Economics, vol. 104, December 2021

- Cavapozzi D., Dal Bianco C., 2021, The effect of work disability on the job involvement of older workers, Journal of Economic Behavior and Organization, Journal of Economic Behavior & Organization, vol. 192, December 2021, pp. 724-739

- Cavapozzi D., Francesconi M., Nicoletti C., 2021, The impact of gender role norms on mothers’ labor supply, Journal of Economic Behavior & Organization, vol. 186, June 2021, pp 113-134

- Colonnello S., HerpferC., 2021, Do Courts Matter for Firm Value? Evidence from the US Court System, The Journal of Law & Economics, vol. 64, 2

- Colonnello S., Koetter M., Stieglitz M., 2021, Benign Neglect of Covenant Violations: Blissful Banking or Ignorant Monitoring?, Economic inquiry, vol. 59, 1, pp 459-477

- Corazza M., Di Tollo G., Fasano G., Pesenti R., 2021, A novel hybrid PSO-based metaheuristic for costly portfolio selection problems, Annals of Operations Research, vol. 304, pp 109-137

- Corò G., Plechero M., Rullani F., Volpe M., 2021, Industry 4.0 technological trajectories and traditional manufacturing regions: the role of knowledge workers, Regional Studies, vol. 55, 10-11

- Costola M., Iacopini M., Santagiustina C.R.M.A., 2021, On the “mementum” of meme stocks, Economics Letters, vol. 207, October 2021

- Crosato L., Domenech J., Liberati C., 2021, Predicting SME’s default: Are their websites informative?, Economics Letters, vol. 204, July 2021

- Dotti V., 2021, Reaching across the aisle to block reforms, Economic Theory, vol. 72, pp 553-578

- Dragone D., Raggi D., 2021, Resolving the milk addiction paradox, Journal of Health Economics, vol. 77, May 2021

- Dunz N., Essenfelder A.H., Mazzocchetti A., Monasterolo I., Raberto M., 2021, Compounding COVID-19 and climate risks: The interplay of banks’ lending and government’s policy in the shock recovery, Journal of Banking & Finance, September 2021

- Faggian S., Gozzi F., Kort P.M., 2021, Optimal investment with vintage capital: Equilibrium distributions, Journal of Mathematical Economics, vol. 96, October 2021

- Jagannathan R., Pelizzon L., Schaumburg E., Sherman M.G., Yuferova D., 2021, Recovery from fast crashes: Role of mutual funds, Journal of Financial Markets, vol. 59, part B, June 2022

- Jappelli T., Marino I., Padula M., 2021, Social Security Uncertainty and Demand for Retirement Saving, Review of income and Wealth, vol. 67, 4, pp 810-834

- Lisi D., Moscone F., Tosetti E., Vinciotti V., 2021, Hospital quality interdependence in a competitive institutional environment: Evidence from Italy, Regional Science and Urban Economics, vol. 89, July 2021

- Masnadi M.S., Benini G., El-Houjeiri H.M., Milivinti A., Anderson J.E., Wallington T.J., De Kleine R., Dotti V., Jochem P., Brandt A.R., 2021, Carbon implications of marginal oils from market-derived demand shocks, Nature, vol 599, pp 80-84

- Ortiz-Barrios M., Cabarcas-Reyes J., Ishizaka A., Barbati M., Jaramillo-Rueda N., Carrascal-Zambrano G., 2021, A hybrid fuzzy multi-criteria decision making model for selecting a sustainable supplier of forklift filters: a case study from the mining industry, Annals of Operations Research, vol. 307, pp 443-481

- Piras S., PAncotto F., Righi S., Vittuari M., Setti M., 2021, Community social capital and status: The social dilemma of food waste, Ecological Economics, vol. 183, May 2021

- Roncoroni A., Battiston S., D'Errico M., Hałaj G., Kok C., 2021, Interconnected banks and systemically important exposures, Journal of Economic Dynamics and Control, vol 133, December 2021

- Roncoroni A., Battiston S., Escobar-Farfán L.O.L., Martinez-Jaramillo S., 2021, Climate risk and financial stability in the network of banks and investment funds, Journal of Financial Stability, vol. 54, June 2021

- Wing I.S., De Cian E., Mistry M. N., 2021, Global vulnerability of crop yields to climate change, Journal of Environmental Economics and Management, vol. 109, September 2021

2020

- Aliverti E., Lum K.,Johndrow J., Dunson D.B., 2020, Removing the influence of a group variable in high-dimensional predictive modelling, Journal Of The Royal Statistical Society. Series A. Statistics In Society

- Barbieri E., Di Tommaso M. R., Pollio C., Rubini L., 2020, Getting the specialization right. Industrialization in Southern China in a sustainable development perspective, World Development, vol. 126, February 2020

- Ferrarini A., Barbieri E., Biggeri M., Di Tommaso M. R., 2020, Industrial policy for sustainable human development in the post-Covid19 era, World Development, vol. 137, January 2021

- Barucca P., Bardoscia M., Caccioli F., D'Errico M., Visentin G., Caldarelli G., Battiston S., 2020, Network valuation in financial systems, Mathematical Finance, vol. 30, 4, pp. 1181-1204

- Luu D. T., Napoletano M., Barucca P., Battiston S., 2020, Collateral Unchained: Rehypothecation networks, concentration and systemic effects, Journal of Financial Stability, vol. 52, February 2021

- Bernasconi M., Levaggi R., Menoncin F., 2020, Dynamic Tax Evasion with Habit Formation in Consumption, The Scandinavian Journal of Economics, vol. 122, 3, pp. 966-992

- Albarea A., Bernasconi M., Marenzi A., Rizzi D., 2020, Income Underreporting and Tax Evasion in Italy: Estimates and Distributional Effects, Review of income and Wealth, vol. 66, 4, pp. 904-930

- Brilli Y., Lucifora C., Russo A., Tonello M., 2020, Vaccination take-up and health: Evidence from a flu vaccination program for the elderly, Journal of Economic Behavior & Organization, vol. 179, November 2020, pp. 323-341

- Casarin R., Iacopini M., Molina G., ter Horst E., Espinasa R., Sucre C., Rigobon R., 2020, Multilayer Network Analysis of Oil Linkages, Econometrics Journal, vol. 23, 2, pp. 269-296

- Colonnello S., Koetter M., Stieglitz M., 2020, Benign Neglect of Covenant Violations: Blissful Banking or Ignorant Monitoring?, vol. 59, 1, pp. 459-477

- Colonnello S., 2020, The Real Effects of Universal Banking: Does Access to the Public Debt Market Matter?, Journal of Financial Services Research

- Corazza M., De March D., Di Tollo G., 2020, Design of adaptive Elman networks for credit risk assessment, Quantitative Finance, vol. 21, 2, pp. 323-340

- Corazzini L., Cotton C., Reggiani T., 2020, Delegation and coordination with multiple threshold public goods: experimental evidence, Experimental Economics, vol. 23, December 2020, pp. 1030-1068

- Antinyan A., Corazzini L., Pavesi F., 2020, Does trust in the government matter for whistleblowing on tax evaders? Survey and experimental evidence, Journal of Economic Behavior & Organization, vol. 171, March 2020, pp. 77-95

- Hof A. F., Carrara S., De Cian E., Pflunger B., van Sluisveld M. A. E.,Sytze de Boer H., van Vuuren D. P., 2020, From global to national scenarios: Bridging different models to explore power generation decarbonisation based on insights from socio-technical transition case studies, Technological Forecasting and Social Change, vol. 151, February 2020

- Vesco P., Dasgupta S., De Cian E., Carraro C., 2020, Natural resources and conflict: A meta-analysis of the empirical literature, Ecological Economics, vol. 172, June 2020

- Dindo P., Massari F., 2020, The Wisdom of the Crowd in Dynamic Economies, Theoretical Economics, vol. 15, pp. 1627-1668

- Djordjilovic V., Chiogna M., 2020, Romualdi C., 2020, Simulating gene silencing through intervention analysis, Journal Of The Royal Statistical Society Series C-Applied Statistics, vol. 69, 4, pp. 887-907

- Fabbri G., Faggian S., Freni G., 2020, Policy effectiveness in spatial resource wars: a two-region model, Journal of Economic Dynamics & Control, vol. 111, February 2020

- Ferrari I., 2020, The nativity wealth gap in Europe: a matching approach, Journal of Population Economics, vol. 33, pp. 33-77

- Cabrales A., Feri F., Gottardi P., Mendelez-Jimenez M. A., 2020, Can there be a market for cheap-talk information? An experimental investigation, Games and Economic Behavior, vol. 121, May 2020, pp. 368-381

- Maggian V., Montinari N., Nicolò A., 2020, Do quotas help women to climb the career ladder? A laboratory experiment, European Economic Review, vol. 123, April 2020

- Moscone F., Siciliani L., Tosetti E., Vittadini G., 2020, Do public and private hospitals differ in quality? Evidence from Italy, Regional Science and Urban Economics, vol. 83, July 2020

- Genie M. G., Nicolò A., Pasini G., 2020, The role of heterogeneity of patients' preferences in kidney transplantation, Journal of Health Economics, vol. 72, July 2020

- Donadelli M., Gufler I., Pellizzari P., 2020, The macro and asset pricing implications of rising Italian uncertainty: Evidence from a novel news-based macroeconomic policy uncertainty index, Economics Letters, vol. 197, December 2020

- Bonesso S., Gerli F., Pizzi C., Boyattzis R. E., 2020, The role of intangible human capital in innovation diversification: Linking behavioral competencies with different types of innovation, Industrial and Corporate Change, vol. 29, 3, pp. 661-681

- Ellena M., Breil M., Soriani S., 2020, The heat-health nexus in the urban context: A systematic literature review exploring the socio-economic vulnerabilities and built environment characteristics, Urban Climate, vol. 34, December 2020

- Spiganti A., 2020, Can Starving Start-ups Beat Fat Labs? A Bandit Model of Innovation with Endogenous Financing Constraint, The Scandinavian Journal of Economics, vol. 122, 2, pp. 702-731

- Petrovic M., Ozel B., Teglio A., Raberto M., Cincotti S., 2020, Should I stay or should I go? An agent-based setup for a trading and monetary union, Journal of Economic Dynamics & Control, vol. 113, April 2020

- Tonellato S. F., 2020, Bayesian nonparametric clustering as a community detection problem, Computational Statistics & Data Analysis, vol. 152, December 2020

- Di Tommaso M., Tassinari M., Barbieri E., Marozzi M., 2020, Selective industrial policy and ‘sustainable’ structural change. Discussing the political economy of sectoral priorities in the US, Structural Change and Economic Dynamics, vol. 54, September 2020, pp. 309-323

- Basso A., Funari S., 2020, A three-system approach that integrates DEA, BSC, and AHP for museum evaluation, Decisions in Economics and Finance, vol. 43, pp. 413-441

- Billio M., Donadelli M., Livieri G., Paradiso A., 2020, On the role of domestic and international financial cyclical factors in driving economic growth, Applied Economics, vol. 52, 11, pp. 1272-1297

- Brilli Y., Restrepo B. J., 2020, Birth weight, neonatal care, and infant mortality: Evidence from macrosomic babies, Economics and Human Biology, vol. 37, May 2020

- Brilli Y., Lucifora C., Russo A., Tonello M., 2020, Influenza vaccination behavior and media reporting of adverse events, Health Policy, vol. 124, 12, pp. 1403-1411

- Bassetti F., Casarin R., Rossini L., 2020, Hierarchical Species Sampling Models, Bayesian Analysis, vol. 15, 3, pp. 809-838

- Colonnello S., 2020, Executive Compensation and Labor Expenses, The B.E. Journal of Economic Analysis & Policy, vol. 20, 1

- Marini M. M., Garcia-Gallego A., Corazzini L., 2020, Communication in a threshold public goods game with ambiguity, Applied Economics, vol. 52, 53

- Khalifa A. A. A., Caporin M., Costola M. Hammoudeh S.M., 2020, Systemic Risk for Financial Institutions in the Major Petroleum-based Economies: The Role of Oil, The Energy Journal, vol. 42, pp. 245-272

- Randazzo T., De Cian E., Mistry M. N., 2020, Air conditioning and electricity expenditure: The role of climate in temperate countries, Economic Modelling, vol. 90, August 2020, pp. 273-287

- Colelli F. P., De Cian E., 2020, Cooling demand in integrated assessment models: a methodological review, Environmental Research Letters, vol. 15, 11

- Ginbo T., Di Corato L., Hoffman R., 2020, Investing in climate change adaptation and mitigation: A methodological review of real-options studies, Ambio, vol. 50, pp. 229-241

- Page C. M., Djordjilović V., Nøst T. H., Ghiasvand R. Sandanger T. M., Frigessi A., Thoresen M., Veierød M. B., 2020, Lifetime Ultraviolet Radiation Exposure and DNA Methylation in Blood Leukocytes: The Norwegian Women and Cancer Study, Scientific Reports, vol. 10

- Ferretti P., Zolin M. B., Ferraro G., 2020, Relationships among sustainability dimensions: evidence from an Alpine area case study using Dominance-based Rough Set Approach, Land Use Policy, vol. 92, March 2020

- Anzilli L., Giove S., 2020, Multi-criteria and medical diagnosis for application to health insurance systems: a general approach through non-additive measures, Decisions in Economics and Finance, vol. 43, pp. 559-582

- Essenfelder A. H., Giupponi C., 2020, A coupled hydrologic-machine learning modelling framework to support hydrologic modelling in river basins under Interbasin Water Transfer regimes, Environmental Modelling & Software, vol. 131, September 2020

- Donadelli M., Jüppner M., Paradiso A., Ghisletti M., 2020, Tornado activity, house prices, and stock returns, The North American Journal Of Economics And Finance, vol. 52, April 2020

- Frattarolo L., Parpinel F., Pizzi C., 2020, Combining permutation tests to rank systemically important banks, Statistical Methods & Applications, vol. 29, pp. 581-596

- Pavone P., Pagliacci F., Russo M., Righi S., Giorgi A., 2020, Multidimensional clustering of EU regions. A contribution to orient public policies in reducing regional disparities, Social indicators Research

- Lagomarsino E., Spiganti A., 2020, No gain in pain: psychological well-being, participation, and wages in the BHPS, The European Journal of Health Economics, vol. 21, pp. 1375-1389

- Bertani F., Ponta L., Raberto M., Teglio A., Cincotti S., 2020, The complexity of the intangible digital economy: an agent-based model, Journal of Business Research, vol. 129, May 2021, pp. 527-540

- Jones A. M., Rice N., Zantomio F., 2020, Acute health shocks and labour market outcomes: Evidence from the post crash era, Economics and Human Biology, vol. 36, January 2020

- Zolin M.B., Ferretti, P., Grandi, M., 2020, Sustainability in Peripheral and Ultra-Peripheral Rural Areas through a Multi-Attribute Analysis: The Case of the Italian Insular Regionhttps://doi.org/10.3390/su12229380, Sustainability vol. 12, 22

2019

- Bassetti F., Casarin R., Rossini L., 2019, Hierarchical Species Sampling Models, Bayesian Analysis, vol. 15, 3, pp. 809-838

- Casarin R., Costola M., 2019, Structural changes in large economic datasets: A nonparametric homogeneity test, Economic Letters, vol. 176, Mar 2019, pp. 55-59

- Corazzini L., Galavotti S., Valbonesi P., 2019, An experimental study on sequential auctions with privately known capacities, Games and Economic Behavior, vol. 117, Sep 2019, pp. 289-315

- Colonnello S., Curatola G., Gioffrè A., 2019, Pricing sin stocks: Ethical preference vs. risk aversion, European Economic Review, vol. 118, Sep 2019, pp. 69-100

- Djordjilović V., Page C. M., Gran J. M., Nøst T. H., Sandanger T. M., Veierød M. B., Thoresen M., 2019, Global test for high-dimensional mediation: Testing groups of potential mediators, Statistics in Medicine, vol. 38, 18, pp. 3346-3360

- Di Corato L., Maoz Y., 2019, Production externalities and investment caps: A welfare analysis under uncertainty, Journal of Economic Dynamics and Control, vol. 106, Sep 2019

- Gottardi P., Maurin V., Monnet C., 2019, A theory of repurchase agreements, collateral re-use, and repo intermediation, Review of Economic Dynamics, vol. 33, Jul 2019, pp. 30-56

- Teglio A., Mazzocchetti A., Ponta L., Raberto M., Cincotti S., 2019, Budgetary rigour with stimulus in lean times: Policy advices from an agent-based model, Journal of Economic Behavior & Organization, vol. 157, Jan 2019, pp. 59-83

- Bernasconi M., Levaggi R., Menoncin F., 2019, Dynamic Tax Evasion with Habit Formation in Consumption, Scandinavian Journal of Economics, pp. 1-27

- Vinciotti V., Tosetti E., Moscone F., Lycett M., 2019, The effect of interfirm financial transactions on the credit risk of small and medium‐sized enterprises, Journal of the Royal Statistical Society Series A - Statistics in Society, vol. 182, 4, pp. 1205-1226

- Raberto M., Ozel B., Ponta L., Teglio A., Cincotti S., 2019, From financial instability to green finance: the role of banking and credit market regulation in the Eurace model, Journal of Evolutionary Economics, vol. 29, pp. 429-465

- Vadean F., Randazzo T., Piracha M., 2019, Remittances, Labour Supply and Activity of Household Members Left-Behind, Journal of Development Studies, vol. 55, 2, pp. 278-293

- Caporin M., Corazzini L., Costola M., 2019, Measuring the Behavioural Component of the S&P 500 and its Relationship to Financial Stress and Aggregated Earnings Surprises, British Journal of Management, vol. 30, 3, pp. 712-729

- Donadelli M., Paradiso A., Livieri G., 2019, Adding Cycles into the Neoclassical Growth Model, Economic Modelling, vol. 78, May 2019, pp. 162-171

- Donadelli M., Paradiso A., Riedel M., 2019, A Quasi Real-Time Leading Indicator for the EU Industrial Production, Manchester School, vol. 87, 4, pp. 510-542

- Randazzo T., Piracha M., 2019, Remittances and Household Expenditure Behavior: Evidence from Senegal, Economic Modelling, vol. 79, June 2019, pp. 141-153

- Baghdasaryan V., Iannantuoni G., Maggian V., 2019, Electoral fraud and voter turnout: An experimental study, European Journal of Political Economy, vol. 58, June 2019, pp. 203-219

- Liuzzi D., Pellizzari P., Tolotti M., 2019, Fast traders and slow price adjustments: an artificial market with strategic interaction and transaction costs, Journal of Economic Interaction and Coordination, vol. 14, pp. 643-662

- Corazza M., Nardelli C., 2019, Possibilistic mean-variance portfolios vs. probabilistic ones: The winner is..., Decisions In Economics and Finance, vol. 42, pp. 51-75

- Ozel B., Nathanael R. C., Raberto M., Teglio A., Cincotti S., 2019, Macroeconomic implications of mortgage loan requirements: an agent-based approach, Journal of Economic Interaction and Coordination, vol. 14, pp. 7-46

- Bonato M., Cian F., Giupponi C., 2019, Combining LULC data and agricultural statistics for A better identification and mapping of High nature value farmland: A case study in the veneto Plain, Italy, Land Use Policy, vol. 83, April 2019, pp. 488-504

- Zelingher R., Ghermandi A., De Cian E., Mistry M., Kan I., 2019, Economic Impacts of Climate Change on Vegetative Agriculture Markets in Israel, Environmental & Resource Economics, vol. 74, pp. 679-696

- Belloni M., Brugiavini A., Raluca E. B., Carrino L., Cavapozzi D., Orso C. E., Pasini G., 2019, What do we learn about redistribution effects of pension systems from internationally comparable measures of Social Security Wealth?, Journal of Pension Economics and Finance, pp. 1-19

- Di Novi C., Marenzi A., 2019, The smoking epidemic across generations, genders, and educational groups: A matter of diffusion of innovations, Economics and Human Biology, vol. 33, May 2019, pp. 155-168

- Nardon M., Pianca P., 2019, Behavioral premium principles, Decisions In Economics and Finance, vol. 42, pp. 229-257

- Lucchetta M., Moretto M., Parigi B. M., 2019, Optimal bailouts, bank’s incentive and risk, Annals of Finance, vol. 15, pp. 369-399

- Gerolimetto M., Magrini S., 2019, Testing for boundary conditions in case of fractionally integrated processes, Statistical Methods & Applications

- Bisaglia L., Gerolimetto M., 2019, Model-based INAR bootstrap for forecasting INAR(p) models, Computational Statistics, vol. 34, pp. 1815-1848

- Allevi E., Basso A., Bonetti F., Oggini G., Riccardi R., 2019, Measuring the environmental performance of green SRI funds: A DEA approach, Energy Economics, vol. 79, pp. 32-44

- Bagagiolo F., Faggian S., Maggistro R., Pesenti R., 2019, Optimal control of the mean field equilibrium for a pedestrian tourists’ flow model, Networks and Spatial Economics, pp. 1-24

- De Cian E., Pavanello F., Randazzo T., Mistry M., Davide M., 2019, Households’ adaptation in a warming climate. Air conditioning and thermal insulation choices, Environmental Science & Policy, vol. 100, October 2019, pp. 136-157

- Donadelli M., Gerotto L., Lucchetta M., Arzu D., 2019, Immigration, Uncertainty, and Macroeconomic Dynamics, World Economy, vol. 43, 2, pp. 326-354

- Barbieri E., Di Tommaso M. R., Pollio C., Rubini L., 2019, Industrial Policy in China: The Planned Growth of Specialised Towns in Guangdong Province, Cambridge Journal of Regions, Economy and Society, vol. 12, 3, pp. 401-422

- Barbieri E., Pollio C., Prota F., 2019, The impacts of spatially targeted programmes: evidence from Guangdong, Regional Studies, vol. 54, 3, pp. 415-428

- Bottazzi G., Dindo P., Giachini D., 2019, Momentum and reversal in financial markets with persistent heterogeneity, Annals of Finance, vol. 15, pp. 455-487

- Campostrini S., Carrozzi G., Severoni S., Masocco M., Salmaso S., 2019, Migrant health in Italy: a better health status difficult to maintain-country of origin and assimilation effects studied from the Italian risk factor surveillance data, Population Health Metrics, vol. 17, 14

- Cambrea D. R., Colonnello S., Curatola G., Fantini G., 2019, CEO investment of deferred compensation plans and firm performance, Journal Of Business Finance & Accounting, vol. 46, 7-8, pp. 944-976

- Bonesso S., Gerli F., Pizzi C., Boyatzis R. E., 2019, The role of intangible human capital in innovation diversification: Linking behavioral competencies with different types of innovation, Industrial and Corporate Change, pp. 1-21

- Billio M., Donadelli M., Livieri G., Paradiso A., 2019, On the role of domestic and international financial cyclical factors in driving economic growth, Applied Economics, vol. 52, 11, pp. 1272-1297

- Crosato L., Grossi L., 2019, Correcting outliers in GARCH models: a weighted forward approach, Statistical Papers, vol. 60, pp. 1939-1970

- Moscone F., Skinner J., Tosetti E., Yasaitis L., 2019, The association between medical care utilization and health outcomes: A spatial analysis, Regional Science and Urban Economics, vol. 77, July 2019, pp. 306-314

- Auster S., Gottardi P., 2019, Competing mechanisms in markets for lemons, Theoretical Economics, vol. 14, pp. 927-970

- Markandya A., De Cian E., Drouet L., Polanco-Martinez J. M., 2019, Building Risk into the Mitigation/Adaptation Decisions simulated by Integrated Assessment Models, Environmental & Resource Economics, vol. 74, pp. 1687-1721

- Casarin R., Correa J. C., Camargo J. E., Dakduk S., Ter Horst E., Molina G., 2019, What makes a tweet be retweeted? A Bayesian trigram analysis of tweet propagation during the 2015 Colombian political campaign, Journal of Information Science, pp. 1-9

2018

- D’Errico M., Battiston S., Peltonen T., Scheicher M., 2018, How does risk flow in the credit default swap market?, Journal of Financial Stability, vol. 35, Apr 2018, pp. 53-74

- Karpf A., Mandel A., Battiston S., 2018, Price and network dynamics in the European carbon market, Journal of Economic Behavior & Organization, vol. 153, Sep 2018, pp. 103-122

- Stolbova V., Monasterolo I., Battiston S., 2018, A financial macro-network approach to climate policy evaluation, Ecological Economics, vol. 149, Jul 2018, pp. 239-253

- Dindo P., Staccioli J., 2018, Asset prices and wealth dynamics in a financial market with random demand shocks, Journal of Economic Dynamics and Control, vol. 95, Oct 2018, pp. 187-210

- Casarin R., Tonellato S., 2018, Comment on Bayesian Cluster Analysis: Point Estimation and Credible Balls by Wade and Ghahramani, Bayesian Analysis, vol. 13, pp. 604-605

- Tonellato S., Iacopini M., 2018, Contributed discussion to Using Stacking to Average Bayesian Predictive Distributions, Bayesian Analysis

- Costantini M., Paradiso A., 2018, What do panel data say on inequality and GDP? New evidence at US state-level, Economics Letters, vol. 168, Jul 2018, pp. 115-117

- Bertin G., Carrino L., Giove S., 2018, The Italian Regional Well-Being in a Multi-expert Non-additive Perspective, Social indicators Research, vol. 135, Jan 2018, pp. 15-51

- Bottazzi G., Dindo P., Giachini D., 2018, Long-run heterogeneity in an exchange economy with fixed-mix traders, Economic Theory, vol. 66, pp. 407-447

- Maggian V., Montinari N., Nicolò A., 2018, Backscratching in Hierarchical Organizations, Journal of Law, Economics and Organization, vol. 34, 2, pp. 133-161

- Casarin R., Molina G., ter Horst E., 2018, A Bayesian time varying approach to risk neutral density estimation, Journal of the Royal Statistical Society Series A - Statistics in Society, vol. 182, 1, pp. 165-195

- Di Novi C., Marenzi A., Rizzi D., 2018, Do healthcare tax credits help poor-health individuals on low incomes?, The European Journal Of Health Economics, vol. 19, pp. 293-307

- Bonesso S., Gerli F., Pizzi., Cortellazzo L., 2018, Students’ entrepreneurial intentions: The role of prior learning experiences and emotional, social and cognitive competencies, Journal of Small Business Management, vol. 56, S1, pp. 215-242

- Billio M., Casarin R., Osuntuyi A., 2018, Markov switching GARCH models for Bayesian hedging on energy futures markets, Energy Economics, vol. 70, February 2018, pp. 545-562

- Costantini M., Meco I., Paradiso A., 2018, Do inequality, unemployment and deterrence affect crime over the long run?, Regional Studies, vol. 52, 4, pp. 558-571

- Basso A., Casarin F., Funari S., 2018, How well is the museum performing? A joint use of DEA and BSC to measure the performance of museums, Omega, vol. 81, December 2018, pp. 67-84

- Di Novi C., Rizzi D., Zanette M., 2018, Scale Effects and Expected Savings from Consolidation Policies of Italian Local Healthcare Authorities, Applied Health Economics and Health Policy, vol. 16, pp. 107-122

- Ponta L., Raberto M., Teglio A., Cincotti S., 2018, An Agent-based Stock-flow Consistent Model of the Sustainable Transition in the Energy Sector, Ecological Economics, vol. 145, March 2018, pp. 274-300

- Moro A., Pellizzari P., 2018, A computational model of labor market participation with health shocks and bounded rationality, Knowledge and Information Systems, vol. 54, pp. 617-631

- Casarin R., Foroni C., Marcellino M., Ravazzolo F., 2018, Economic Uncertainty Through the Lenses of A Mixed-Frequency Bayesian Panel Markov Switching Model, The Annals of Applied Statistics, vol. 12, 4, pp. 2559-2586

- Caporin M., Pelizzon L., Ravazzolo F., Rigobon R., 2018, Measuring sovereign contagion in Europe, Journal of Financial Stability, vol. 34, February 2018, pp. 150-181

- Miglietta P., Giove S., Toma P., 2018, An optimization framework for supporting decion making in biodiesel feedstock imports: Water footprint vs. import costs, Ecological Indicators, vol. 85, February 2018, pp. 1231-1238

- Antinyan A., Corazzini L., 2018, Relative Standing and Temporary Migration: Empirical Evidence from the South Caucasus, Review of Development Economics, vol. 22, 1, pp. 361-383

- Carrino L., Orso C. E., Pasini G., 2018, Demand of long-term care and benefit eligibility across European countries, Health Economics, vol. 27, 8, pp. 1175-1188

- Barro D., Canestrelli E., Consigli G., 2018, Volatility versus downside risk: performance protection in dynamic portfolio strategies, Computational Management Science, vol. 16, pp. 433-479

- Dasgupta S., De Cian E., 2018, The influence of institutions, governance, and public opinion on the environment: Synthesized findings from applied econometrics studies, Energy Research & Social Science, vol. 43, September 2018, pp. 77-95

- Nardon M., Pianca P., 2018, European option pricing under cumulative prospect theory with constant relative sensitivity probability weighting functions, Computational Management Science, vol. 16, pp. 249-274

- Farinosi F., Giupponi C., Reynaud A., Ceccherini G., Carmona-Moreno C., De Roo A., Gonzalez-Sanchez D., Bidoglio G., 2018, An innovative approach to the assessment of hydro-political risk: A spatially explicit, data driven indicator of hydro-political issues, Global Environmental Change-Human and Policy Dimensions, vol. 52, September 2018, pp. 286-313

- Collier W., Piracha M., Randazzo T., 2018, Remittances and return migration, Review of Development Economics, vol. 22, 1, pp. 174-202

- Angelini V., Bertoni M., Corazzini L., 2018, Does Paternal Unemployment Affect Young Adult Offspring’s Personality?, Journal of Human Capital, vol. 12, 3, pp. 542-567

- Barbieri E., Rubini L., Pollio C., Micozzi., 2018, What are the trade-offs of academic entrepreneurship? An investigation on the Italian case, The Journal of Technology Transfer, vol. 43, pp. 198-221

- De Cian E., Dasgupta S., Hof A. F., van Sluisveld M. A. E., Kohler J., Pfluger B., van Vuuren D. P., 2018, Actors, decision-making, and institutions in quantitative system modelling, Technological Forecasting and Social Change, vol. 151

- Brugiavini A., Cavapozzi D., Padula M., Pettinicchi Y., 2018, On the effect of financial education on financial literacy: evidence from a sample of college students, Journal of Pension Economics and Finance, pp. 1-9

- Di Corato L., Moretto M., Vergalli S., 2018, The effects of uncertain forest conservation benefits on long-run deforestation in the Brazilian Amazon, Environment and Development Economics, vol. 23, 4, pp. 413-433

- Di Corato L., Brady M. V., 2018, Passive farming and land development: A real options approach, Land Use Policy, vol. 80, January 2019, pp. 32-46

- Mazzocchetti A., Raberto M., Teglio A., Cincotti S., 2018, Securitization and business cycle: an agent-based perspective, Industrial and Corporate Change, vol. 27, 6, pp. 1091-1121

- Hernando-Veciana A., Michelucci F., 2018, Inefficient rushes in auctions, Theoretical Economics, vol. 13, 1, pp. 273-306

Development

From a methodological point of view, the research activity of the Centre requires the development of:

- new methods and econometrics models for the analysis of large databases, high frequency data and georeferenced data, taking into particular consideration the interaction with other disciplines such as statistics, mathematics and machine learning;

- agent based model and multi-agent model for simulating interactions among heterogeneous actors to evaluate effects and impacts on the policy decisions system;

- lab and field experiments is a prerequisite for the link between different techniques of data collection, data analysis and data modelling in economic and social fields.

Researchers at the Department of Economics already have experience and produce scientific results in these fields making it possible to develop frontier research, and applied research over the five years of the project (and beyond).